Understanding Accounts Payable Strategies: A Guide to Accuracy and Efficiency

What is accounts payable? Think of it like a list that a company keeps showing all the money they need to pay other people for things they bought or services they used. It's like when you list bills you must pay such as your electricity or phone bill but for a business.

Why should we deal with this list quickly and carefully? If you need to pay a bill or make a mistake you might get charged extra or mess up your budget. For businesses making mistakes with their bills can cause more significant problems like spending too much money or having trouble with other companies they buy from. That's why businesses need to keep their accounts payable neat and tidy.

Trusted10.io knows that keeping track of all these bills can be tricky to ensure they are right and timely especially with many payments. We've got lots of great advice on how to make handling accounts payable easier and quicker. Whether you're just starting or looking for ways to improve we've got your back with tips and tricks to help your accounts payable process run smoothly.

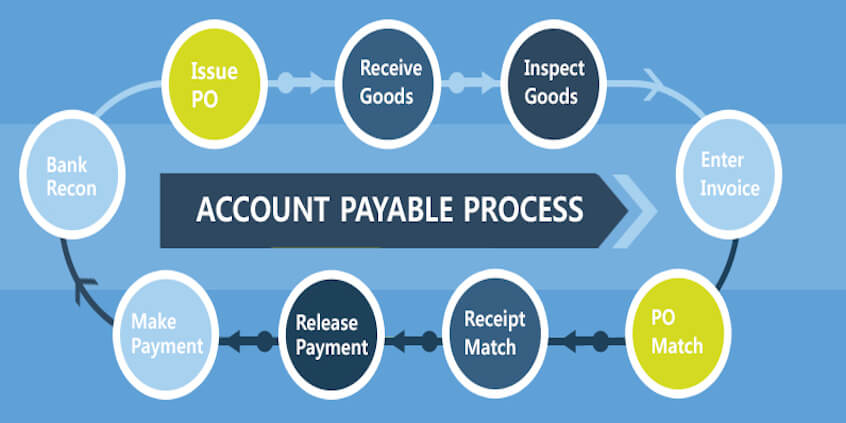

Accounts Payable Best Practices

Consider accounts payable like a list of bills a company must pay. Keeping this list neat and organized is essential so the company can be innovative with its money.

1: Keep Things Simple: Like cleaning up your room so everything is easy to find. Companies need to keep their bill-paying process simple too. They ensure that every bill has the proper papers and that someone has said it's okay to pay.

2: Who Can Pay the Bills: Just as only certain people might have the key to a treasure chest companies make sure only certain people can say yes to paying bills. This keeps everything safe and sound.

3: Which Bill to Pay First: Imagine you have a few chores to do. You decide which one to do first based on how urgent it is. Companies do the same with their bills. They determine which ones need to be paid soonest and plan their money around that.

4: Using Computers to Help: Just like a video game can make learning fun companies use computers and special programs to make paying bills faster and less likely to have mistakes.

5: Keeping an Eye Out for Tricks: Sometimes people try to trick companies into paying money they shouldn't. Companies observe to ensure everything looks correct with their bills like playing detective.

6: Talking to People You Owe Money: If a company knows it will be late paying a bill it might call the person it owes money to and ask for more time. Similar to how "please" and "thank you" may be helpful it can be spoken.

7: Making Approvals Quick: Companies use computer programs to check bills faster.

8: Keeping Everything in Order: Companies use a unique system to keep track of all the people they need to pay. It helps them stay friends with these people and pay their bills on time.

By following these simple steps companies can pay their bills correctly and keep their money safe. It's all about being organized careful and intelligent with money.

Improving Accounts Payable Efficiency

Companies can use innovative tools and sound plans to boost the smoothness and speed of handling bills (what we call accounts payable). These tricks make everything faster save money and make work easier. Here are some intelligent moves companies can make:

1: Go Paperless: Imagine not having to deal with piles of paper bills anymore. Companies use special computer programs to handle bills quickly and without mistakes. This saves money and time and even catches discounts for paying early.

2: Make a Plan for Bills: Companies set up a clear path for dealing with bills ensuring everything is done the same way every time. They also decide which bills to pay first based on when they're due helping to use money wisely.

3: Pay with a Click: Instead of writing checks companies pay their bills online. This is faster there's no risk of losing anything in the mail and it's cheaper because you don't need stamps or envelopes.

4: Keep Score: Just like in sports companies keep track of their bill-paying game. They watch how many bills they get how much they spend on each how quickly they pay them and if they grab discounts. This helps them get better and faster.

5: Let Computers Do the Work: By using automation companies cut down on mistakes made by people speed up approvals and make the whole process more efficient.

6: Get the Details Right: With intelligent tools companies can spot where things are slowing down or if something's wrong with their bills. This helps fix problems fast.

7: Smooth Out Buying to Paying: Companies make the journey from buying something to paying the bill as smooth as possible. This makes better financial management and an overview of the whole process possible.

8: Keep Everything Tight: Companies ensure that only the right people can handle bills and payments closely monitoring the process. This keeps things safe and sound.

By using these intelligent moves companies can handle their bills like pros saving money and time and making their work life much easier.

Streamlining the Accounts Payable Process

Making it easy for businesses to pay their expenses is what we're talking about. This means setting up a good plan so everything goes smoothly not having to do lots of things by hand and using computers to help make things quicker and with fewer mistakes.

Easy Steps:

- Have a Plan: It's like having a recipe for a cake. You need to know what steps to follow so everything mixes well.

- Pay Bills on the Computer: Instead of using paper and stamps companies can pay their bills on the computer which is faster and easier.

- Be Nice to People You Buy From: It's vital to talk nicely and clearly with the people you need to pay. In certain cases this might even lead to a more favorable negotiation outcome.

- Use Computer Helpers: There are special computer programs that can do much bill-paying work which helps avoid mistakes and makes things faster.

- Check How You're Doing: It's like looking at a scoreboard. Companies need to keep an eye on how well they're doing at paying bills and see where they can get better.

How Computers Help:

- Special Programs: These are like magic tools on the computer that help pay bills quickly save money make sure you're paying the right people and keep track of everything happening.

- Doing Things Online: Using the computer to handle bills say "yes" to payments and share updates quickly.

- Making Things Better: Computers can also help ensure everything is done right and efficiently when paying bills.

By following these simple steps and using computers companies can make paying bills much more straightforward do less by hand make fewer mistakes and save money.

Implementation Challenges and Solutions

When companies try to improve how they handle their bills (accounts payable) they might run into some bumps. Don't worry though; there is a way out of every problem! Let's look at some types of hiccups and how to get rid of them:

Common Hiccups:

- Doing Things by Hand: When things are done by hand mistakes can happen things might take longer and it might cost more.

- Paying Late: If bills are paid late it can mess up the money flow and upset the people you buy from.

- No Time for Big Ideas: The team might need to be more relaxed with day-to-day tasks to consider significant improvements.

- Suppliers Have Questions: People you buy from might often ask about their bills because they're unsure what's happening.

- Too Many Emails and Papers: Doing things old-fashioned can mean many emails and piles of paper.

- Using Different Systems: If there are too many different computer systems it can make things more apparent and more manageable.

- Hard to See What's Going On: If it's tough to see where the money's going or what's happening with bills making intelligent choices can be challenging.

- Can't Handle More Work: If things get busier the old ways might fail to keep up.

- Stopping Fraud is Tricky: It can be hard to spot and prevent fraud without the right tools.

Smooth Solutions:

- Use Automation: Computer programs can take over routine tasks reduce mistakes and make things faster.

- Make a Standard Plan: A straightforward way to do things can ensure everything is done right and quickly.

- Go Digital for Payments: Paying bills online can make things faster reduce the chance of losing important papers and save on paper costs.

- Set Goals (KPIs): Keep track of significant numbers like how many bills are processed and how quickly to see where things can improve.

- Build Good Relationships with Suppliers: A good relationship with the people you buy from can help avoid late payments and other problems.

- Keep Getting Better: Always look for faster and better ways to pay your bills.

- Follow the Rules: Make sure to follow all the rules to keep good relationships with suppliers and keep track of money appropriately.

- Predict the Future: Stay ahead by knowing what new changes and ideas are coming in handling bills.

By tackling these hiccups with intelligent solutions companies can make paying bills smoother faster more reliable and suitable for everyone involved.

Regulatory Compliance in Accounts Payable

Keeping things in line with rules and standards in bill paying (accounts payable) is super important. It's like playing a game where you must follow the rules to avoid getting into trouble keep good relationships with your friends (vendors) and make sure everyone thinks well of you. It's also vital for making smart money decisions and watching for sneaky behavior.

Staying on the Right Track: Rules and Tips

- Follow a Plan: Use a transparent system for organizing payments.

- Let Computers Help: Use special computer programs for bill paying that make following the rules more straightforward and help avoid mistakes or sneaky behavior.

- Set Up Checks and Balances: Have different people check different parts of the bill-paying process.

- Be Good to Your Suppliers: Keep a solid and open relationship with the people you buy from. It's like being a good friend who is honest and transparent about everything.

- Constantly Be Improving: Regularly check how you pay bills to find any hiccups or slow spots that need fixing.

- Keep Things Clear: Make sure you can see and understand every step of the bill-paying process just like watching a movie from start to finish without missing any parts.

- Look Out for Risks: Look out for anything that might cause trouble inside and outside your company.

By sticking to these rules and tips businesses can ensure they're playing the bill-paying game right avoiding trouble keeping good friends and staying in good shape money-wise.

Vendor Relationship Management

Maintaining relationships with the people and companies you buy stuff from (vendors) is super important for businesses. It's not just about picking the right vendors; it's also about making those relationships solid and helpful for everyone. Managing these relationships well makes paying bills (accounts payable) smoother builds trust and improves everything.

How to Make Vendor Friendships Strong and Helpful:

- Be Ready to Change: Things change constantly – what you need what your vendors can do and what's happening worldwide. Being able to adjust keeps partnerships strong.

- Pick Your Vendors Wisely: Take your time to find vendors who fit what your business needs and who you can work well with.

- Plan Together: Talk to your sellers about how you can meet your goals as a team. It's like being on the same team.

- Have a Plan B: Sometimes unexpected stuff happens. Having a backup plan means you can keep going without too much stress.

- Keep an Eye on Things: Keep an eye on your suppliers. If something's wrong discussing it sooner rather than later is better.

- Be Fair in Negotiations: When discussing contracts or prices look for suitable solutions for both of you. Making sure everyone gets a piece of pie is like that.

- Pay on Time: Paying your bills on time shows that you're reliable and respectful which is vital for building trust.

- Look for Value Not Just Cheap Prices: Getting a good deal is great but ensuring you're getting good quality and service worth the price is more important.

By following these tips businesses can build great relationships with their vendors making managing bills smoother and more efficient and helping everyone involved be more successful.

Continuous Improvement Strategies

Keeping the way a company pays its bills getting better all the time is essential. It helps things go smoothly makes fewer mistakes and saves money. Matters are in good shape. Listening to people's ideas looking at the numbers and checking how well things are going can make things better step by step.

Ways to Keep Getting Better:

- Make Work Easier: Look at how you do your work and remove steps you don't need making everything quicker and smoother.

- Use Computers for Bills: Start doing your bills on the computer to use less paper make fewer mistakes and speed things up.

- Help from Computers: Use tools that let the computer do some typing which means less work by hand fewer mistakes and quicker work.

- Know How You're Doing: Set goals like how quickly you can handle a bill and keep checking to see where you can do better.

- Don't Pay Twice: Make sure you don't pay the same bill two times which saves money and keeps things right.

- Decide Who Checks Payments: Make rules for who needs to review and okay payments ensuring things don't slow down.

- Check Your Math: Review your accounts regularly to ensure all the numbers are correct and fix any mistakes.

- Always Try to Do Better: Always look for little ways to do things better and more quickly.

How Feedback Data and Keeping Score Help:

- Feedback: Listen to the team handling the bills; they can tell you where things get tricky and how to improve them.

- Data Analysis: Look at the numbers to see patterns what's taking too long or where mistakes happen and then figure out how to fix those issues.

- Keeping Score: Use straightforward measures (like how many mistakes happen or how much it costs to handle each bill) to see if changes are helping and to set goals.

By following these simple steps and paying close attention to ideas numbers and scores companies can make handling bills easier more accurate and quicker which is suitable for everyone.

Conclusion

Today's chat discussed some great ways to make paying bills more accessible for businesses. We looked at using computers to help with the work making good friends with the people we buy stuff from and consistently trying to find little ways to improve things. Plus we discussed the importance of following the rules and ensuring everything is done right.

Now it's your chance to try these ideas in your business. By trying these tips you can make things run smoother make fewer mistakes and keep your business's money in good shape. Start with a tiny step and see where it takes you. Remember every little bit helps!

If you're looking for more help or ideas Trusted10.io is a great place to start. On our website you'll find lots of helpful stuff like guides articles and tips all about managing money and bills in your business. Plus you can join our online group to talk with other people who might have good advice or stories to share.