Expert Picks: The Leading Accounting Software of 2024

Finding the right tool to handle money is important especially if you're running a business or working independently. These tools help you monitor your cash simplifying your life. Now that it's 2024 there are lots of options to choose from. It's all about picking the one that's just right for your needs.

Every new year we get new tools that promise to make handling money easier. The challenge lies in identifying the tool that simplifies the process and provides insights into your financial transactions and business performance. With so many choices this year it's like trying to pick the best apple from a big pile.

At Trusted10.io we're here to help you spot the top picks for 2024. We look at all the different tools out there examining their offerings and ease of use. We're all about making it easy for you to find the best tool for managing your money.

1 Intuit QuickBooks Online

Intuit QuickBooks Online is like a handy helper for smaller businesses. It lets you manage money on a computer or phone so you can do it anywhere. It's perfect for companies with a small team and works well with many other computer programs to make things even more accessible.

What It Can Do:

- Make Nice Bills: You can create professional bills and show off your business style.

- Talk to Clients: It has a unique space where you and your clients can chat and share important stuff.

- Watch Your Money: It monitors your income and expenses without requiring much effort on your part.

- Sort Your Spending: It helps put your spending into different buckets so you know where your money goes.

- Keep Project Tabs: You can check on your projects to see how they're doing with money and time.

- Report Card: Detailed reports give you a big picture of your financial situation.

- App on the Go: You can use it on your phone which is super handy.

- Safe and Sound: Keep your money details safe with extra security steps.

Pros and Cons:

Pros:

- Easy to Use: Getting around and finding what you need is straightforward.

- Numerous Tools: It offers numerous features to assist with various financial tasks.

- Works with Others: Can join hands with other programs to do more stuff.

- Knows the Numbers: Reports give you a clear picture of your business's finances.

- Phone-Friendly: You can complete your financial tasks on your phone too.

- Keeps Data Safe: Your money details are well protected.

Cons:

- Costs a Bit: Starting might cost more than other similar helpers.

- Some Limits: The cheapest option lets you do less than the others.

- Help When You Need It: Depending on your salary you may only get some of the help you want.

QuickBooks Online is great for keeping your business money organized and safe even though it may cost a bit more and have some limitations on the cheaper plan. It's a good pick for smaller businesses that want to stay on top of their money game.

2 Xero

Xero is like a smart assistant for smaller businesses helping them handle money matters via the Internet. Xero is brimming with tools that facilitate bill sending spending monitoring and bank reconciliation. Xero is handy for businesses looking to make their money-making tasks easier and faster. Plus you can use Xero's mobile app to stay on top of finances anywhere you go and its simple design makes it easy to use.

What It Can Do:

- Send Bills and Quotes: Quickly create and send out bills to customers.

- Track Spending: Monitor your spending and its location closely.

- Match with the Bank: This helps make sure your bank and business records are the same.

- Watch Over Projects: Keep tabs on how your projects are doing money-wise.

- Manage Inventory: This helps you track what you have in stock.

- Order Stuff: Create orders for things you need to buy for your business.

- Report Card: Gives a clear view of how your business is doing with detailed reports.

- Safe and Sound: Protects your business information with vital security steps.

Pros and Cons:

Pros:

- Easy to Use: Finding your way around is a breeze.

- Full of Features: It has everything you need for managing business finances.

- Handy Mobile App: Keep your finances in check on your phone.

- Keeps Data Safe: Your financial information is well protected.

- Smart Reports: To better understand your business get detailed reports.

- Excellent Price: The plans are wallet-friendly.

Cons:

- Needs More Friends: It only works with so many other programs as other tools.

- Takes Some Learning: Getting used to it may take a bit.

- Help When You Need It: If you're on a smaller plan you might get only some of the help you want.

Xero is an excellent choice for keeping your business's finances organized and safe. It boasts numerous useful features and comes at a reasonable price. Though it might not work with as many other tools and could take a little time to learn it's a solid helper for small to medium businesses.

3 FreshBooks

FreshBooks is like a friendly helper for people working independently or running small businesses. It uses the internet to help you handle money issues easily from sending bills to keeping track of time and expenses. FreshBooks makes these tasks simple so you can spend more time on your work and less time on paperwork. Its design is super easy to use and it can do many things by itself making it a go-to choice for people who want a no-fuss way to manage their money.

What It Can Do:

- Send Bills and Get Paid: Create and send bills easily and manage payments.

- Keep Track of Time and Projects: Manage your work and see how much time you spend on tasks.

- Watch Your Spending: Track what you're spending and where.

- Work Together with Clients: Share updates and work closely with your clients online.

- Automate Regular Bills: Set up bills to send themselves on a regular basis.

- App on the Go: The mobile app allows you to manage money tasks from anywhere.

- Work with Other Tools: Connects with other business tools you might use.

- Safe and Sound: Keeps your business information safe with solid security.

Pros and Cons:

Pros:

- Easy to Use: Getting around and finding what you need is straightforward.

- Makes Invoicing Easy: Sending out bills and tracking expenses is straightforward.

- Saves You Time: There are lots of automatic features to save time.

- Helpful Support: If you need help you can get great customer service.

- Handy Mobile App: Manage your business finances from your smartphone.

- Friendly Pricing: The plans are affordable.

Cons:

- Not for Big Businesses: They might need more for larger companies.

- Could Have More Features: They might need all the advanced tools some need.

- Limited Report Tweaks: A few ways to change reports.

- Simple Project Tools: The project management tools are essential.

FreshBooks is an excellent option for freelancers and small businesses that want an easy and efficient way to manage their finances. While it's super user-friendly and suitable for the basics bigger businesses or those needing detailed features might need to look further.

4 Zoho Books

Zoho Books is a smart tool that helps smaller and medium-sized businesses keep their money matters in check without a hassle. Because it operates entirely online you can manage tasks like sending bills monitoring spending and managing projects from any location. Zoho Books is fantastic for simplifying those tricky money tasks with a layout that's easy to use and many ways to work with other programs you might already use.

What It Can Do:

- Send Bills and Handle Payments: Create and send out bills as well as keep track of payments coming in.

- Track Your Spending: Keep track of your expenses and what you must pay.

- Manage Projects and Time: Keep your projects organized and track how much time you spend on them.

- Match with the Bank: Ensure your bank information matches your books.

- Keep Inventory in Check: Manage what you have in stock for your business.

- Order Stuff: Easily create orders for things you need for your business.

- Report Card: Get detailed reports to see how your business is doing financially.

- Safe and Sound: Protect your financial information with solid security features.

Pros and Cons:

Pros:

- Easy to Use: The layout makes finding what you need and getting things done simple.

- Packed with Features: It has all the tools you need to manage your business finances.

- Works Well with Others: You can connect with many other programs to make your life easier.

- Friendly Prices: Offers plans that won't break the bank.

- Smart Reports: With detailed reports you can get a clear picture of your business finances.

- Keeps Data Safe: Your financial information is well protected.

Cons:

- Reports Can't Change Much: You might be unable to tweak reports how you want.

- Might Take Time to Learn: Some folks might need help getting the hang of it first.

- Help When You Need It: The assistance you receive can depend on your chosen plan.

- Simple Project Tools: The project management tools are basic.

Zoho Books is a top choice for businesses that want a straightforward and effective way to handle their finances. It has many features and good security. It might take some time for some people to learn how to use it and the report-making process could offer more flexibility.

5 Wave Accounting

Because it's free Wave Accounting is like a treasure trove for small businesses! Wave Accounting assists with all financial tasks including the creation of visually appealing bills online payment processing and maintaining the organization of all your financial data. Wave aims to simplify financial management for small business owners by providing a streamlined platform for all financial tasks.

What It Can Do:

- Make Nice Bills: You can create professional bills and show off your business.

- Receive Payment Online: Allow your customers to directly pay you through the bills you send.

- Automatic Number Crunching: Keeps your money details straight without you sweating over them.

- Everything in One Place: It connects your billing with your accounting so it's all together.

- Easy to Use: The main screen is simple so you can find everything you need fast.

- Stay Organized: Keep all your financial stuff neat so you can sleep easily.

Pros and Cons:

Pros:

- Totally Free: You never have to pay anything to use it.

- Simple to Navigate: It's effortless to find your way around.

- All Connected: Invoicing and accounting work together like best friends.

- Quick Payments: Your customers can pay you faster via bill.

- Keep It Neat: Helps you stay on top of your financial matters without a fuss.

Cons:

- Might Feel Small: If your business gets big Wave might not grow with it.

- Wants More Tools: It doesn't have all the fancy features of some paid tools.

- Set Reports: You may need to modify the reports to suit your preferences.

- Missing Some Bits: It might need to do some technical things.

- Help on Hand: Because it's free the assistance you receive may be less than with paid tools.

Wave Accounting is a fantastic choice for small businesses that need a helpful straightforward way to manage their money without spending a dime. While it's perfect for keeping things simple and organized businesses growing fast or needing concrete tools might need to look further.

6 Sage

Sage is like a big toolbox for businesses no matter how big or small. Its tools work on your computer or in the cloud which means you can keep tabs on your business money and stuff from anywhere. Sage 50cloud its newest tool is really cool because it mixes the usual computer stuff with cloud magic letting you see all your business numbers and things you have in stock in one place.

What It Can Do:

- Watch Your Cash: It helps you watch your money coming in and going out.

- Make Your Bills Special: You can create bills that fit your business style.

- Automatic Bank Stuff: Connects to your bank so your records are always up-to-date.

- Sort Your Accounts: Make sure all your numbers match up without a headache.

- Keep track of stuff: Know exactly what you have in stock and where it is.

- Handle Projects: This helps you manage your projects and see how they work.

- Pay Your Team: Paying your team makes payroll a lot simpler.

- Reports: It gives you all sorts of reports so you know how your business is doing.

Pros and Cons:

Pros:

- Lots of Tools: It has features for all your business needs.

- Cloud Magic: You can access your information anytime and anywhere thanks to cloud connectivity.

- Make It Yours: There are lots of ways to make bills and reports look just how you want.

- Smart Tracking: Advanced tools to monitor your stock and projects.

- Plays Well with Others: Works with other programs such as Microsoft 365.

Cons:

- Update Yourself: Since it's based on your computer you might have to update it yourself.

- Team Work Limited: If you're not accustomed to using cloud-based tools working together might be more challenging.

- Take Some Learning: Some folks might need help getting used to it.

Sage is a powerhouse for businesses that want to have a lot of control over their finances stock and payroll. It offers a mix of old-school and new-school tools. While it's super helpful businesses that love cloud-based stuff might find it a bit old-fashioned and learning all its tricks might take some time.

7 AccountEdge Pro

AccountEdge Pro is like a Swiss Army knife for small business owners who use Macs or Windows. It has everything you need to keep track of sales bills what you're spending and even what's in stock. Plus it's great for ensuring you pay your team on time and keep in touch with your customers. Since its inception in 1989 AccountEdge Pro has consistently assisted businesses in managing their finances monitoring expenses and simplifying the banking process.

What It Can Do:

- Sell and Bill: Make and send out bills for what you sell.

- Keep an eye on expenses: Track your spending and manage your bills.

- Banking Made Easy: Connects with your bank to keep your accounts in check.

- Pay Your Team: Handle paying your employees.

- Know Your Stock: Monitor what you have available for sale.

- Bill for Your Time: You are covered if you charge by the hour.

- Stay Close to Customers: Tools to manage your relationships with customers.

- Look at the Numbers: Analyze your data to see how your business is doing.

Pros and Cons:

Pros:

- Packed with Tools: It has all the necessary features to run your business smoothly.

- Friendly for Users: It's made to be easy to use even if you're not a tech whiz.

- Keep Customers Happy: Great tools for managing your customer relationships.

- Banking Sync: Bank feeds keep your financial records up to date automatically.

- Make It Your Own: There are many ways to customize bills and reports to suit your business.

Cons:

- Update by Hand: Being a desktop program you need to update it yourself.

- Might Feel Small: If your business gets small it might need to catch up.

- Learning Takes Time: Some folks might need time to learn how to use it.

- Team Work Limited: Offers less collaboration than online programs.

- Could Use More Features: It may not have all the fancy options of some online tools.

AccountEdge Pro is a solid choice for small businesses looking for a reliable way to manage their finances and customer relationships especially if you prefer a desktop solution. While it's super handy and packed with features businesses planning to grow quickly or those looking for the latest online bells and whistles might need to look a bit further.

8 ZarMoney

ZarMoney is like a multi-tool for business money matters built for any business size. It makes life easier by letting your customers pay their bills right away. With ZarMoney you can keep track of sales inventory quotes and more in one spot. ZarMoney simplifies tasks such as billing stock monitoring and generating quotes or estimates.

What It Can Do:

- Billing with Easy Pay: Send out bills that let customers pay with just a click.

- Quick Bill Making: It pulls information from your customer list to fill out bills quickly.

- Find Bills in a Snap: Easily search for any bill you need.

- Keep track of stock: Always know what you have in your inventory.

- Quotes and Estimates: Quickly generate quotes or estimates for your customers.

- Statements: Create clear statements for your accounts.

Pros and Cons:

Pros:

- All-In-One: Handles accounting billing and stock all together.

- Easy-Pay on Bills: This makes it easy for customers to pay you right from their bill.

- Speedy Billing: It fills out bills quickly using your customer information.

- Simple to Find Bills: There's no hassle in finding any bill you want.

Cons:

- More Info Needed: It's hard to find details on extra features or how it works with other tools.

- What People Say: There are only a few reviews to see what others think.

ZarMoney packs a punch with its all-in-one approach to handling business finances from billing to inventory. ZarMoney's design prioritizes speed and simplicity particularly through its innovative "Pay Now" feature on invoices. But it may be a leap of faith due to the lack of detailed information on its extra bells and whistles and what other users have to say about it.

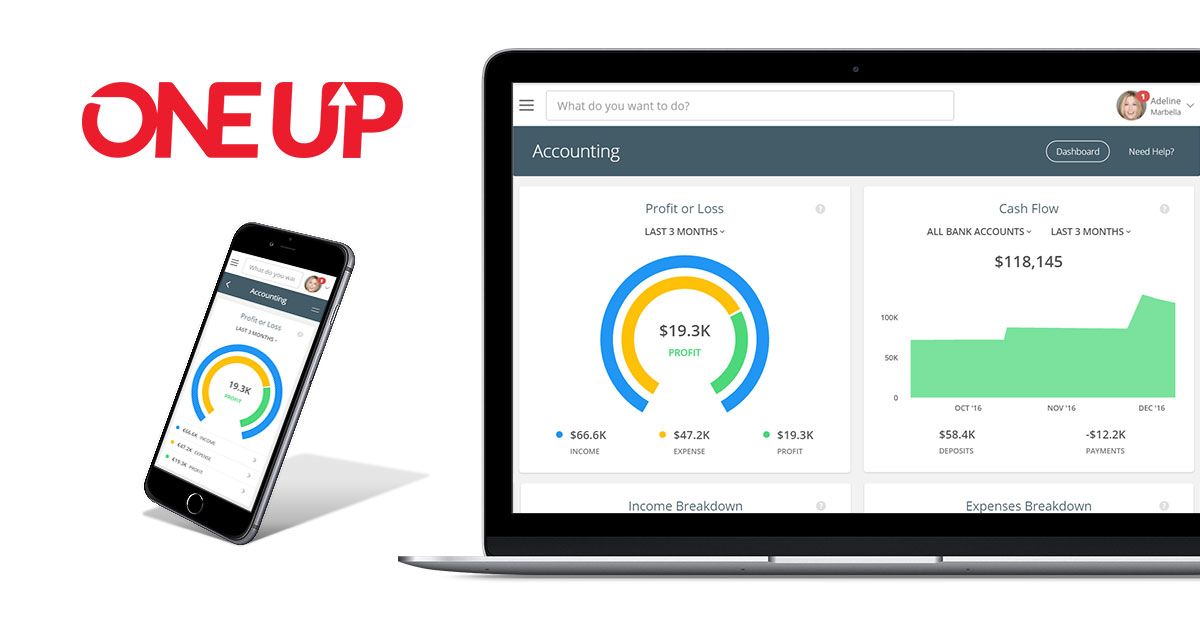

9 OneUp

OneUp is a cloud-based helper for small businesses that keeps track of things like banking billing spending and what you've got in stock. It's pretty neat because it updates your financial information in real-time and works well with other online tools like Shopify Amazon and Square. This makes OneUp a wise choice for businesses seeking to maintain seamless operations without becoming overwhelmed by data.

What It Can Do:

- Banking on Auto-Pilot: Matches your bank stuff automatically to keep books tidy.

- Bill and Quote Magic: Send out bills and quotes without a fuss.

- Eye on Expenses: It tracks what you're spending and where.

- Stock Savvy: Helps you manage what you're selling.

- Order Organizing: Handling purchase orders is easy.

- Reports at a Glance: Get clear reports on your business.

- Always in Sync: Keeps your financial data updated in real-time.

- Plays Nice with Others: Works with big online sales and payment platforms.

Pros and Cons:

Pros:

- Up-to-date: Because it's cloud-based your financial information is always current.

- Banking Made Easy: There's no need to worry about bank stuff; it's automatic.

- E-Commerce friendly: Connects with top online sales and payment tools.

- Know Your Numbers: Offers detailed reports to help you understand your business better.

Cons:

- Price Tag Puzzle: More information makes it easier to find out how much it costs.

- What's the Word: More feedback needs to be given from other users.

OneUp is a solid choice for small businesses looking for a cloud-based system that keeps everything from banking to inventory in check. It's convenient to sell online because it connects with popular e-commerce and payment platforms. The catch is that without more details or reviews figuring out the pricing and what other people think about it is tricky.

10 Neat

Neat is like a digital filing cabinet for small businesses but way smarter. It lives in the cloud so you can use it from anywhere to send bills keep track of expenses and even scan receipts so you don't lose them. Neat is all about making the numbers side of your business as painless as possible helping you stay organized without drowning in paperwork.

What It Can Do:

- Billing and Payments: Send out bills and get paid online.

- Expense Watch: Tracks your spending and helps sort it out.

- Receipts in a Snap: Scan your receipts and Neat keeps them safe and sorted.

- Tax Helper: Gives you a hand with tax stuff to keep the taxman happy.

- Teamwork: Let more than one person use it so the whole team can stay on the same page.

- Plays Well with Others: It works with other accounting tools you might already use.

Pros and Cons:

Pros:

- Always Up to Date: Being cloud-based means your information is always current.

- Keeps Things Simple: Makes billing expense tracking and receipt keeping straightforward.

- Tax Time Ease: This helps you prepare for taxes without the headache.

- Friendly Connections: Hooks up with other accounting software you might be using.

Cons:

- Pricing Mystery: If you dig deeper figuring out how much it costs is easier.

- What People Say: There needs to be more feedback from other users.

Neat is an excellent tool for small businesses that want to cut through the clutter and keep their finances tidy especially if they have a lot of receipts or need help getting tax-ready. The main thing to figure out is how much it'll cost you and what other small business owners think about it since there's yet to be much chatter about it.

11 Conclusion

We've looked at many tools in this blog to help businesses with their money tasks like sending bills keeping track of spending and organizing receipts. Each tool offers unique features such as the ability to create online bills for customers to pay the ability to monitor spending and even assistance with tax matters. We discussed tools like QuickBooks Xero Wave and a few others each with cool things to offer for different businesses.

It's super important to pick the right tool to help with your business money. The right one can make things much easier saving you time and stress. It's all about finding the one that fits just right with what you need whether you're a one-person show or a growing business with a team.

For more help choosing the best tool for your money tasks check out Trusted10.io. We've got lots of good advice and information to help you choose wisely. Remember taking a little time now to pick the right tool can significantly affect how smoothly your business runs.