Trusted 10 Accounting Apps Transforming Small Businesses Overnight!

Things can get tricky if you're in charge of money for your small business. Keeping track of all the money coming in going out and getting ready for tax time can be a lot to take. That's where special computer programs or small business accounting software can help. These apps enable you to easily keep an eye on the money coming into and going out of your business saving you time and preventing mistakes.

Finding the right program to help with your business's finances is super important. Nowadays there are even some fantastic free accounting software for small businesses. These free tools can help you make bills track your spending and earnings and create reports. It means you can focus on improving your business instead of thinking about numbers.

That's where Trusted10.io comes in. Our experts know all about the best computer programs for keeping track of your business's money. We've looked at many programs to find the top 10 that can make a big difference for small businesses like yours. This blog will tell you about these top programs what they do and how they can make things easier.

1 QuickBooks Online and Enterprise

QuickBooks Enterprise is a big helper for large businesses. It works on the internet so that you can use it from anywhere and it keeps your data safe daily. It can work for many people in a company up to 40 and has special tools for paying employees keeping track of time and working with Salesforce a customer management tool.

Key Features

- Work together online: You and your team can use it from different places.

- Grows with your business: Good for up to 40 people in your company.

- Help with payroll: Makes paying employees and taxes easier.

- Track time: Keeps an eye on how much time employees work.

- Works with Salesforce: Connects with a tool to help manage customers.

Ease of Use

- Easy to use: It's meant to be simple and clear for everyone.

- Help is always there: You can get help anytime you need it and learn how to use it with special training.

- Works well with others: It can easily connect with other QuickBooks tools you might use.

QuickBooks Enterprise is great for big businesses needing much help with their money. It's easy to use and can do many things to simplify managing money.

2 Xero

Xero is a handy tool for small businesses that work online keeping your business numbers updated constantly. It backs up your data every day so it's safe. Xero simplifies handling money matters with easy billing keeping track of items you sell and managing employee payrolls.

Key Features

- Always online: Access your financial info anytime with safe backups daily.

- Easy to use: Designed to be simple making it easy to manage your money.

- Quick billing: Send out bills fast to get paid quicker.

- Keep track of items: Look at your stock and see what's moving.

- Manage payrolls: Helps with paying employees and figuring out taxes.

Ease of Use

- Friendly design: Xero is made to be easy for everyone to use.

- Help anytime: Support is available 24/7 with training to help you learn.

- Works together: It works better with other Xero tools when you're managing your money.

Xero is great for small businesses that need a simple way to handle their finances online. It's got everything you need to manage money bills items and payrolls all in an easy-to-use package.

3 Zoho Books

Zoho Books is a brilliant online tool for small businesses that keeps your financial information up-to-date and safe with daily backups. It's made to make handling money easier with features for sending out bills keeping track of inventory and managing payroll.

Key Features

- Online and up-to-date: See your finances anytime with your data securely backed up.

- Simple to use: Designed to be simple which makes it easy to handle money matters.

- Billing made easy: Quickly create and send invoices to customers.

- Track your inventory: Watch what you have in stock and what gets bought.

- Payroll help: Automates tax calculations and filings for employee pay.

Ease of Use

- Friendly interface: Zoho Books is built to be easy for anyone to navigate.

- Support when you need it: There's 24/7 support and training to get you started.

- Works well with others: Easily connects with other Zoho tools to make managing your finances smoother.

The online accounting software Zoho Books is great for small businesses that want an easy way to keep track of their money. Its features and easy-to-use design help you efficiently manage invoices inventory and payroll.

4 FreshBooks

FreshBooks is an online accounting tool just right for small businesses. It helps you make invoices track expenses and manage your time. FreshBooks is easy to use from different gadgets and is created to help you work better with your clients. It's known for being simple to use and easy to get to from anywhere.

Key Features

- Available online: Easy to get to your financial info safely from anywhere.

- Make invoices easily: Create good-looking invoices and estimates quickly.

- Watch your expenses: Pay close attention to the money you spend on your business.

- Track your time: Know how much time you spend on projects for better billing.

- Understand your finances: Use reports to see how your business is doing.

Ease of Use

- Straightforward to navigate: FreshBooks has a straightforward interface.

- Great help available: If you need it there's always support ready to help.

- Works with other tools: Connects with apps like G Suite and Slack to help you do more.

- Use it on the go: You can handle your money from anywhere with a mobile app.

- Automated tasks: Some things can be set to do themselves saving time.

FreshBooks is a complete package for small businesses to manage their money matters. With its easy-to-use setup and tools that save time it's a favorite choice for companies wanting to simplify accounting.

5 Wave

Wave is an online accounting tool made for small businesses. It's excellent for creating invoices tracking your spending and looking at your business's money reports. Wave is easy to use and shows you essential info like how much money you have your profits and what you're spending all transparently. It's good at organizing your business's cash and easily matches your bank info with your accounts.

Key Features

- Online access: Get your money info safely from anywhere.

- Good at making invoices: Create professional-looking invoices easily.

- Track spending: Keep an eye on your business expenses.

- Match bank info: Automatically make sure your bank statements and transactions match.

- Extra payroll help: You can add payroll features if you need them.

Ease of Use

- Clear overview: Wave's dashboard makes it easy to see your finances.

- Suitable for accountants: Supports detailed accounting needs.

- Works with other Wave tools: Connects with Wave Payments and Payroll for more features.

- Automates tasks: Helps organize and categorize your money transactions easily.

- Manage on mobile: Use Wave's app to handle your finances anywhere.

Small businesses can use Wave for free which is great if you're just starting out working or running a service-based business on a tight budget. Its simple design and helpful features make managing your business's money much more effortless.

6 Sage 50

Sage 50 which used to be called Peachtree Accounting is a complete accounting tool for small and medium-sized businesses. It helps make invoices track items for sale report on how the company is doing and handle employee payrolls. Sage 50 gives you everything you need to keep your business finances in order watch over expenses and make detailed reports that help you make good decisions.

Key Features

- Professional invoices: Easily create invoices and estimates that look great.

- Track inventory: Watch what you have in stock and what gets bought.

- Business reports: Get detailed reports to see how your business is doing.

- Handle payrolls: Manage how you pay your employees smoothly.

- Check your bank records: Make sure your financial records match your statements.

Ease of Use

- Simple interface: Sage 50 is easy to use with clear steps to follow.

- Lots of help available: If you get stuck there are many things that can help you.

- Works with other Sage tools: Connects with tools like Sage Payroll for even more features.

- Make it yours: You can change the software to fit your business needs.

- Save time with automation: You can save time by not having to do as many things.

Sage 50 is a robust accounting choice for small and medium businesses packed with features to make managing money easier. Its friendly design customization options and ability to do tasks independently make it a go-to choice for businesses wanting to keep their finances neat.

7 Striven

Striven is an online tool designed to help small businesses with money matters. It offers a simple platform to create invoices track expenses and see financial reports. The dashboard is easy to understand showing important info like cash flow and profit. It's easy to do your taxes with Striven because it matches your activities with your bank records immediately.

Key Features

- Online access: Reach your financial info securely from anywhere.

- Professional invoices: Easily create invoices that look great.

- Track expenses: Keep an eye on your business spending.

- Automatic matching: It lines up your bank transactions to keep things tidy.

- Add-on payroll: You can add payroll features if you need them.

Ease of Use

- Clear dashboard: Striven's dashboard makes it easy to see your finances at a glance.

- Double-entry accounting: Good for those who know accounting making things more precise.

- Works with other tools: Striven can connect with its other products for more features.

- Simple tools: It has tools that make categorizing transactions and reconciling accounts more accessible.

- Mobile app: Manage your finances even when you're on the move.

Striven is a handy free accounting software perfect for small businesses freelancers and service-based businesses looking to keep their finances in check without the hassle. Its straightforward interface and helpful features make managing money simpler.

8 ZarMoney

ZarMoney is an online accounting tool made for small businesses. It helps with sending out bills keeping an eye on expenses and looking at financial reports. The dashboard is simple and shows essential things like how much money you have your profits and where you're spending money. ZarMoney makes keeping track of finances easier by automatically organizing your bank transactions.

Key Features

- Online platform: Access your financial info safely from anywhere.

- Create invoices: Make professional-looking bills to send to customers.

- Watch expenses: Keep track of what the business spends money on.

- Match transactions: Automatically lines up your bank info to keep records straight.

- Payroll option: You can add payroll features if your business needs them.

Ease of Use

- Simple dashboard: ZarMoney's dashboard makes seeing all your financial info easy.

- Double-entry accounting: Good for those who know more about accounting for better accuracy.

- It connects with other tools: It can work with other ZarMoney services for more help.

- Easy transaction management: Tools to help organize transactions and reconcile accounts.

- Mobile app: Maintain an awareness of your money matters even when you're not around.

ZarMoney is a helpful free accounting software for small businesses especially those just starting freelancers and service-based companies. It has a simple layout and useful tools that are meant to make handling money easy.

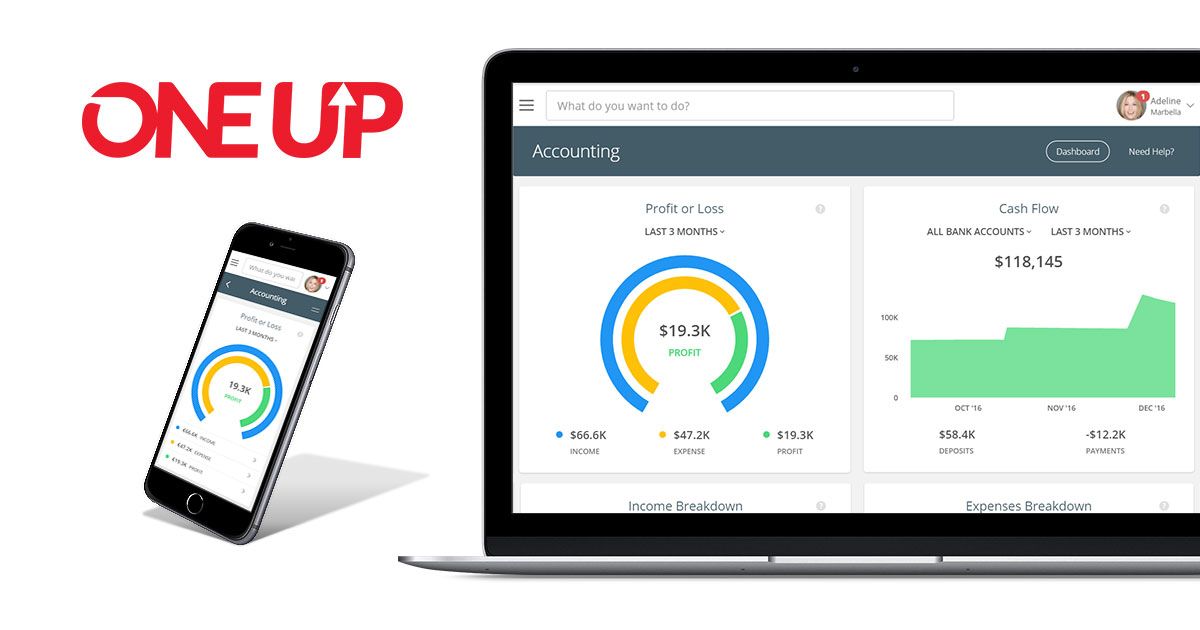

9 OneUp

OneUp is a computer program that helps small business owners handle their money online. It's like a helpful assistant for sending bills keeping track of what you spend and understanding how your business is doing. OneUp has a simple screen that shows you vital financial details like how much money you have and how your business is doing. It makes dealing with money easier by sorting out your bank stuff.

Key Features

- Use it online: You can safely view your business money from any computer or phone.

- Make bills easy: You can quickly make nice-looking bills to send to people.

- Watch what you spend: It helps you monitor your business costs.

- Sort out bank stuff: OneUp matches your bank records so everything is neat.

- Extra for paying people: If you need to pay employees you can add that part too.

Ease of Use

- Easy screen: The main screen is easy to understand and clearly shows your money.

- Suitable for bookkeeping: This will fit right in if you know a bit about bookkeeping.

- Works with other tools: OneUp can work with other OneUp services for more help.

- Handy tools: It has simple tools that help you sort out your money and bank stuff.

- App for your phone: You are never too far away from checking your business money.

OneUp is an excellent choice for small business owners people who work for themselves and anyone offering services who wants a simple way to keep their money in order. It's friendly and easy to use with helpful features to manage your finances better.

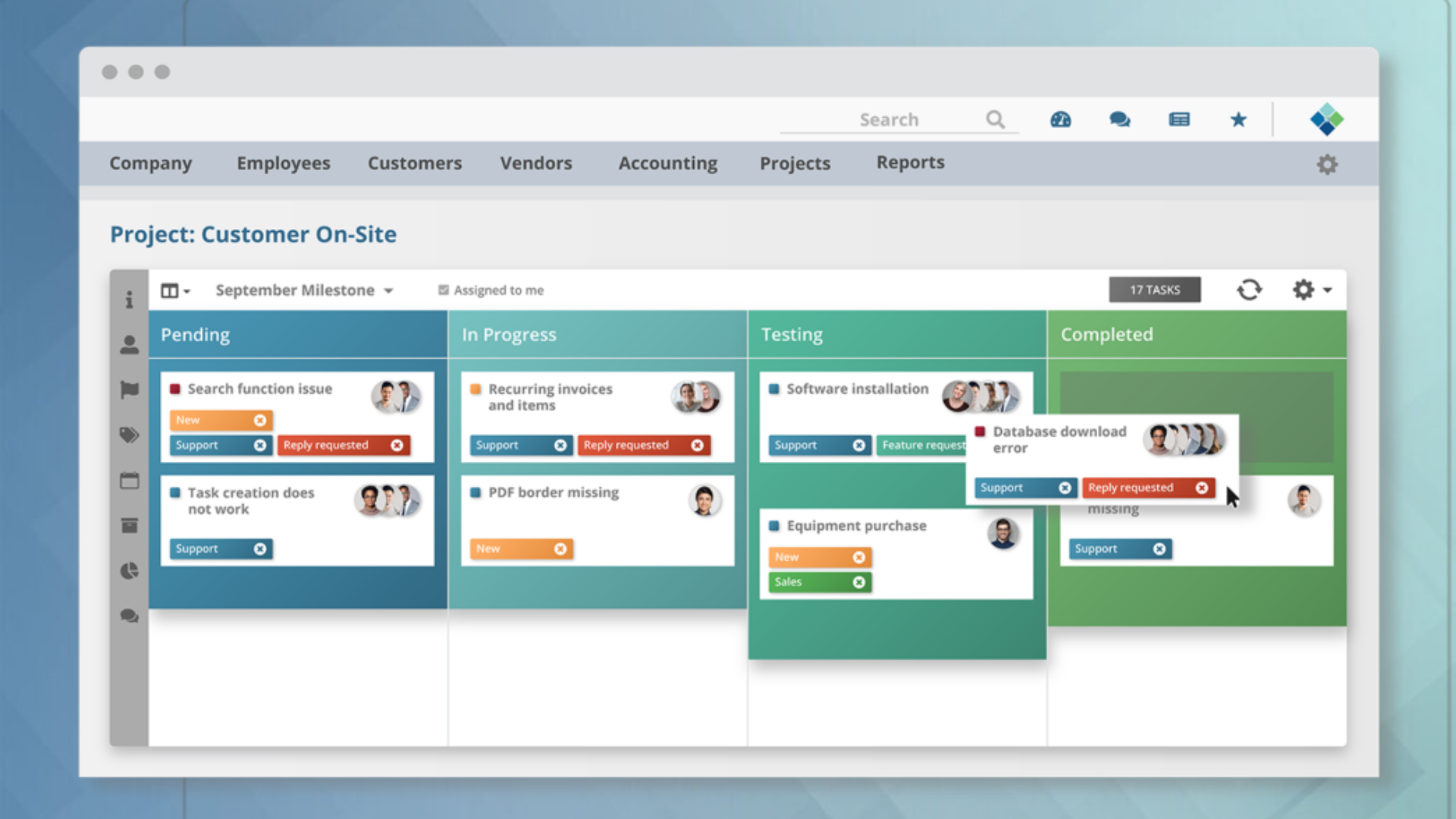

10 Odoo

Odoo is a handy online tool that helps small businesses with money matters like making bills keeping track of spending and understanding how the company is doing with money. It's easy to use showing precise info about your money like what's coming in and going out. Odoo makes keeping track of business money simpler by automatically sorting out bank stuff and helping you see everything clearly on its dashboard.

Key Features

- Available online: You can get your business money info safely from anywhere.

- Make bills easily: Create good-looking bills to send to customers.

- Watch your spending: Keep an eye on where your business money goes.

- Automatic bank sorting: Odoo helps match your bank stuff without the hassle.

- Works everywhere: Set up for business needs in different countries.

- See money info fast: Get quick reports on your business.

- Bright bill handling: Odoo can run other bill formats and remind customers about late payments.

- Plan for coming and going: Plan for when money will come in and when it will go out.

- Innovative taxes: Changes taxes based on where your business is.

Ease of Use

- Clear dashboard: See all your essential money info in one spot easily.

- Suitable for bookkeepers: Has double-entry accounting for those who know bookkeeping.

- Connects with banks: Works with lots of banks for easy money tracking.

- Competent help: Uses smart tech to recognize transactions.

- Mobile friendly: Keep track of expenses and check invoices on your phone.

- Quick reports: Gives you up-to-date reports on your business money.

Odoo is a great free tool for small businesses freelancers and anyone offering services who needs an easy way to manage their finances. It's designed to be straightforward with helpful features for managing bills and expenses and understanding your financial situation better.

Conclusion

In our blog, we discussed some excellent software that can simplify small business accounting with their money. This software can do things like send out bills, keep track of what you're spending, and show you how your business is doing with the money. They're made to be easy to use and can be reached from anywhere, which is super helpful.

These tools can change the game for small businesses. We take away a lot of the headache of handling money, so you can focus more on making your business remarkable. We simplify everything, from paying your team to figuring out your taxes, and they can even help you make smarter decisions about your business.

Don't forget that Trusted10.io can help you find the best business tools. We look at every choice and only suggest the ones they like. We have great advice and can help you choose the right tool to manage your business more efficiently.